All Categories

Featured

Table of Contents

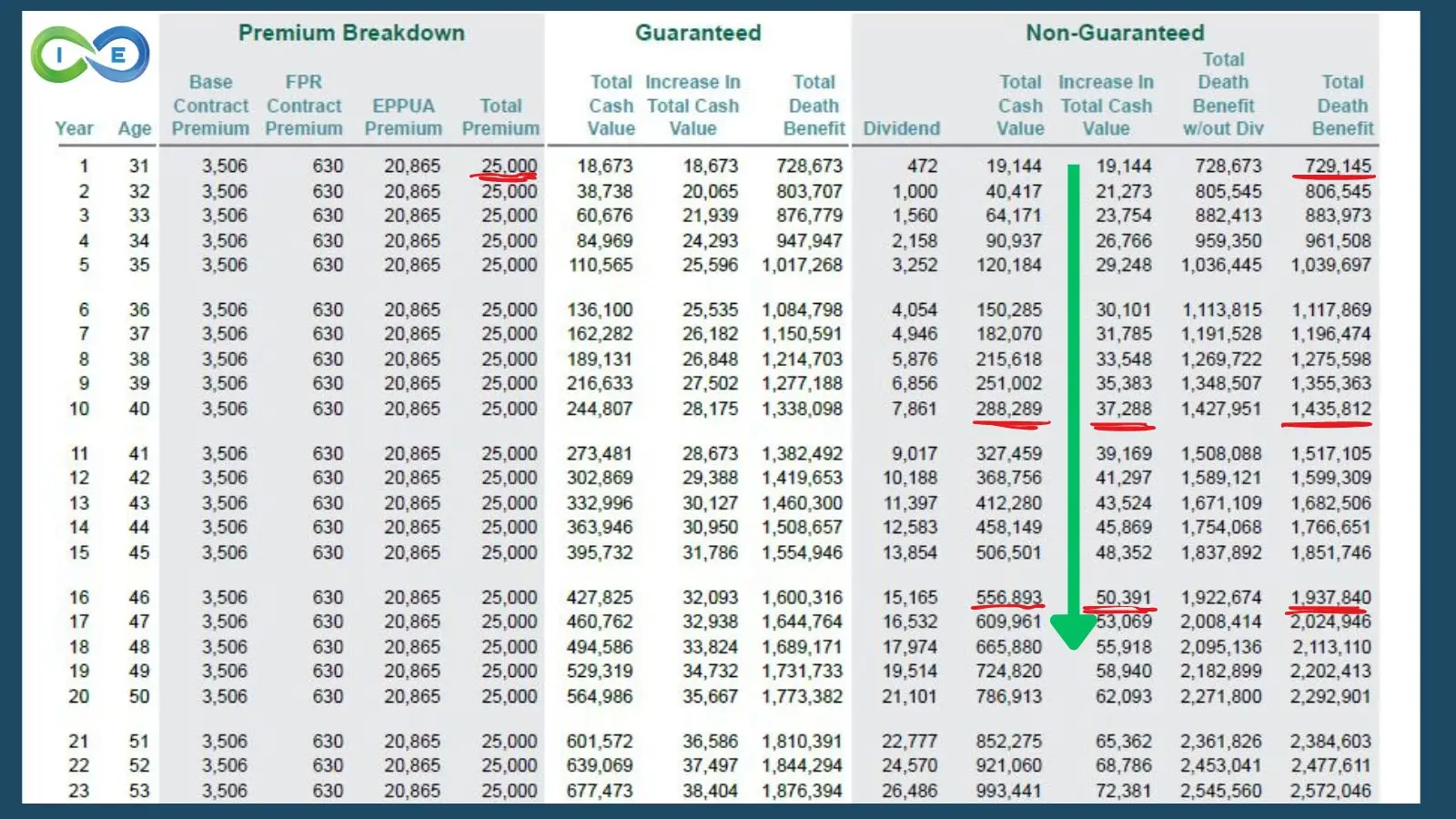

The disadvantages of limitless banking are typically ignored or not mentioned at all (much of the details available concerning this concept is from insurance coverage representatives, which may be a little prejudiced). Just the cash money value is growing at the returns rate. You additionally have to pay for the cost of insurance coverage, fees, and expenditures.

Every permanent life insurance plan is different, but it's clear a person's total return on every dollar invested on an insurance policy item can not be anywhere close to the reward rate for the plan.

Your Own Banking System

To offer a really basic and theoretical example, allow's assume somebody is able to gain 3%, on average, for every buck they invest on an "unlimited banking" insurance item (after all expenditures and charges). If we assume those bucks would be subject to 50% in tax obligations amount to if not in the insurance policy item, the tax-adjusted rate of return could be 4.5%.

We think greater than average returns on the whole life item and a very high tax rate on bucks not put right into the policy (which makes the insurance product look better). The truth for many people might be worse. This pales in comparison to the long-term return of the S&P 500 of over 10%.

Infinite financial is an excellent item for agents that offer insurance policy, but may not be optimum when contrasted to the less expensive options (without sales individuals making fat payments). Right here's a failure of some of the various other supposed benefits of unlimited financial and why they might not be all they're gone crazy to be.

Infinite Bank

At the end of the day you are getting an insurance item. We like the protection that insurance coverage uses, which can be gotten a lot less expensively from an affordable term life insurance coverage plan. Overdue financings from the plan might also reduce your survivor benefit, decreasing an additional degree of protection in the policy.

The concept just works when you not only pay the significant costs, but utilize additional cash to acquire paid-up additions. The possibility cost of all of those bucks is tremendous very so when you might instead be purchasing a Roth Individual Retirement Account, HSA, or 401(k). Also when contrasted to a taxable investment account or perhaps a cost savings account, unlimited financial might not use comparable returns (contrasted to spending) and equivalent liquidity, accessibility, and low/no fee framework (contrasted to a high-yield savings account).

With the surge of TikTok as an information-sharing system, financial advice and strategies have discovered an unique method of spreading. One such strategy that has actually been making the rounds is the boundless financial concept, or IBC for short, amassing recommendations from celebs like rap artist Waka Flocka Flame. Nevertheless, while the method is presently preferred, its roots trace back to the 1980s when economic expert Nelson Nash presented it to the world.

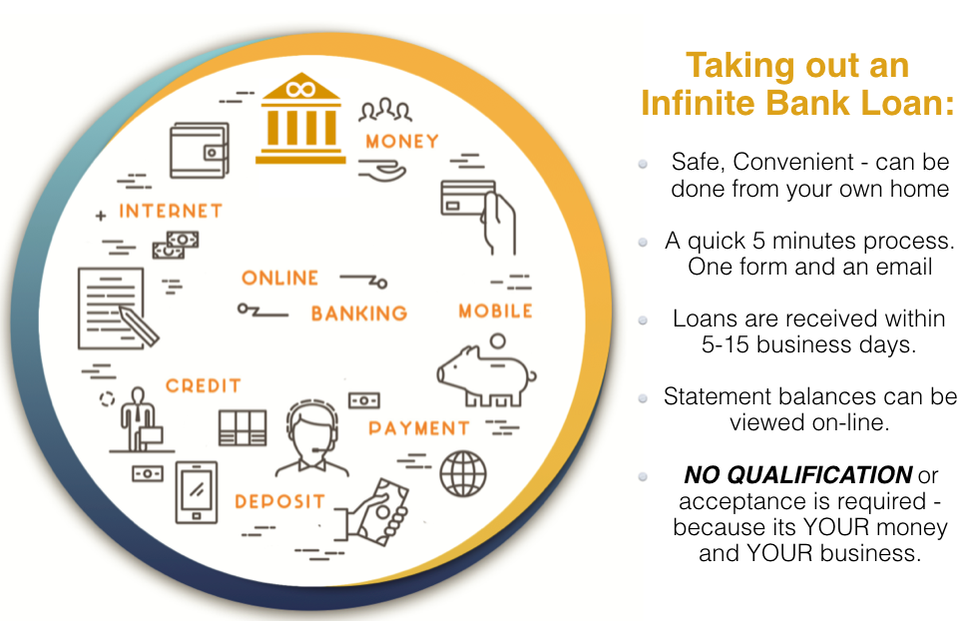

Within these plans, the money value expands based upon a price established by the insurance firm. As soon as a significant cash worth builds up, insurance holders can get a money value lending. These financings differ from standard ones, with life insurance policy acting as security, meaning one can lose their insurance coverage if loaning exceedingly without ample cash value to sustain the insurance costs.

Royal Bank Infinite Visa

And while the attraction of these policies is noticeable, there are inherent restrictions and dangers, requiring diligent cash money worth tracking. The approach's authenticity isn't black and white. For high-net-worth people or entrepreneur, particularly those using methods like company-owned life insurance (COLI), the benefits of tax obligation breaks and compound development can be appealing.

The appeal of unlimited banking doesn't negate its difficulties: Price: The fundamental demand, a long-term life insurance policy policy, is more expensive than its term counterparts. Qualification: Not everyone certifies for whole life insurance coverage due to rigorous underwriting processes that can leave out those with specific health or way of living problems. Complexity and risk: The elaborate nature of IBC, coupled with its dangers, may discourage many, especially when less complex and less dangerous options are readily available.

Alloting around 10% of your monthly revenue to the plan is just not practical for many people. Component of what you check out below is simply a reiteration of what has already been claimed above.

Prior to you obtain yourself right into a scenario you're not prepared for, recognize the complying with first: Although the principle is generally sold as such, you're not in fact taking a loan from on your own. If that were the instance, you would not need to repay it. Rather, you're obtaining from the insurer and have to settle it with passion

Infinite Banking Concept Scam

Some social media blog posts recommend making use of cash money value from entire life insurance policy to pay down credit score card debt. When you pay back the car loan, a section of that passion goes to the insurance coverage company.

For the initial several years, you'll be paying off the compensation. This makes it extremely hard for your plan to build up worth during this time. Unless you can manage to pay a couple of to numerous hundred bucks for the next decade or even more, IBC will not function for you.

If you require life insurance coverage, here are some beneficial tips to think about: Consider term life insurance. Make sure to shop around for the finest price.

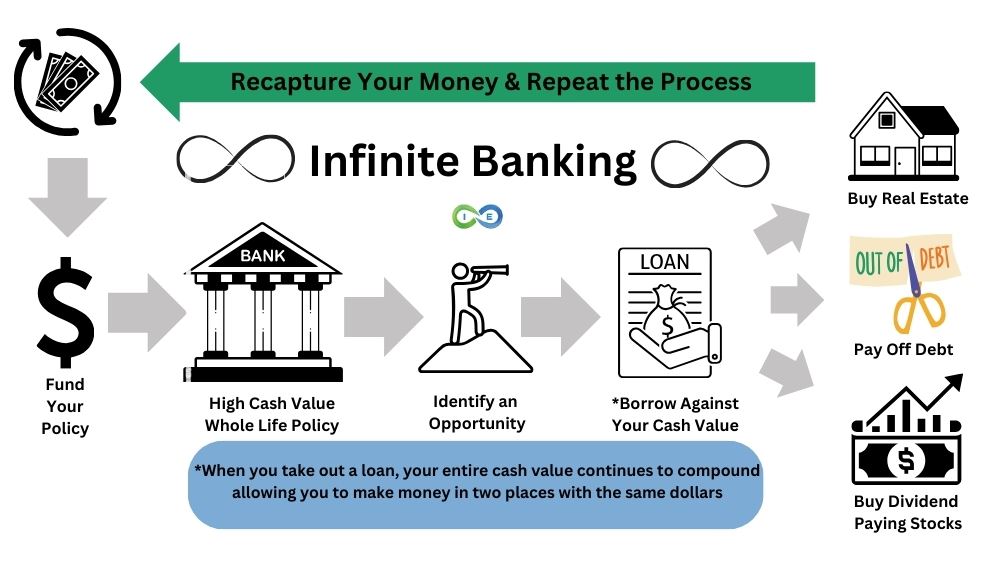

Limitless banking is not a services or product offered by a details organization. Limitless banking is an approach in which you purchase a life insurance policy policy that collects interest-earning cash money value and secure finances against it, "borrowing from on your own" as a resource of resources. After that ultimately pay back the loan and start the cycle all over again.

Pay policy premiums, a section of which develops cash money value. Take a financing out against the plan's cash value, tax-free. If you utilize this principle as intended, you're taking cash out of your life insurance policy to acquire whatever you 'd need for the rest of your life.

Table of Contents

Latest Posts

Be Your Own Banker Nash

How To Create Your Own Bank

The Infinite Banking System

More

Latest Posts

Be Your Own Banker Nash

How To Create Your Own Bank

The Infinite Banking System